When it comes to the crypto wild west, there’s no shortage of projects vying for your attention (and your money). But the truth is, most are built on foundations as shaky as a house of cards. What separates the gold from the garbage? In a nutshell: tokenomics and thoughtful project design. Forget shiny websites and vague promises; the devil, as always, is in the details.

The Cornerstone: Tokenomics 101

Tokenomics is the economic model of a cryptocurrency. Think of it as the DNA of a project. It dictates how tokens are created, distributed, and used within an ecosystem. Get it right, and you’ve got a thriving project. Get it wrong, and you’re building a digital ghost town.

One of the first things to consider is the token supply. Is it fixed, or can more tokens be minted? A fixed supply, like Bitcoin’s 21 million cap, creates scarcity, which can drive up value. But a fixed supply isn’t always the answer. Sometimes, a project needs the flexibility to mint new tokens to reward users or fund development.

Then comes the distribution. How are the tokens allocated? Are they heavily concentrated in the hands of a few whales, or are they spread out among a diverse community? A fair distribution is crucial for decentralization and prevents any one entity from controlling the project. The Federal Reserve, for instance, has noted the impact of such designs on financial stability, emphasizing the need for robust mechanisms.

Finally, there’s the utility of the token. What can you actually *do* with it? Does it grant access to a platform, allow you to vote on proposals, or provide rewards for participation? A token with genuine utility is far more likely to retain value than one that’s just a speculative asset.

Beyond the Basics: Project Design Pitfalls

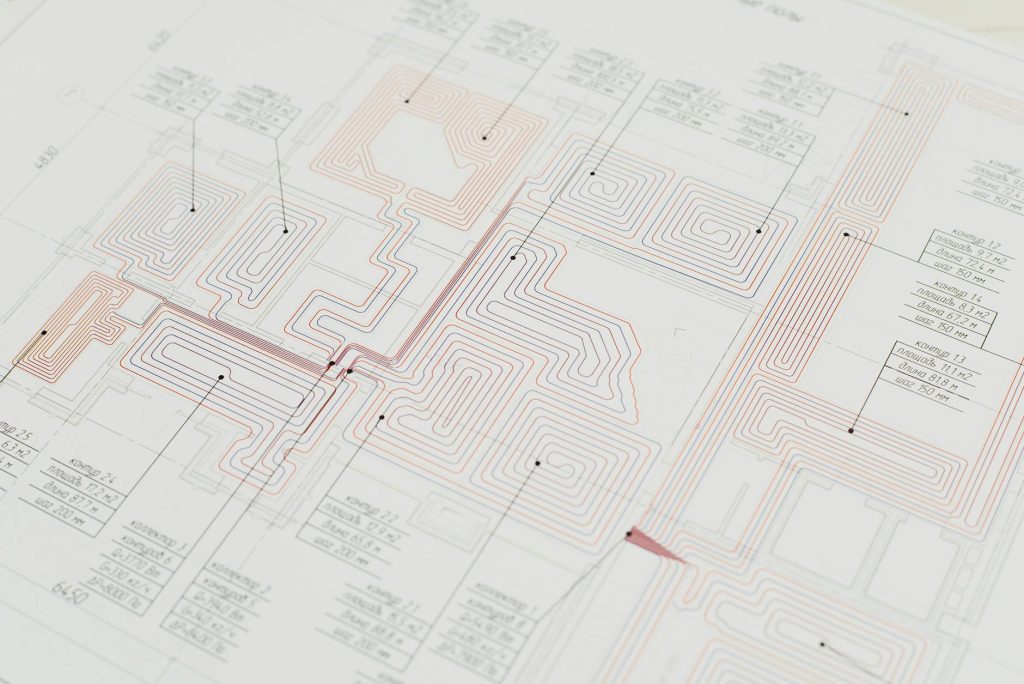

Tokenomics is the foundation, but the overall project design is the architecture. Think of it as the blueprints for a building. A flawed design will lead to a rickety structure. A well-designed project, on the other hand, will weather any storm.

One common mistake is a lack of clear purpose. What problem is the project trying to solve? If the answer is vague or uninspired, the project is dead in the water. Remember, crypto projects need to offer a practical solution and a compelling value proposition to attract users and developers. Consider the DeFi space, where the most successful projects have a clearly defined purpose, whether it’s providing decentralized lending, trading, or yield farming.

Another area where many projects stumble is in their governance. How are decisions made? Are the community members involved in shaping the future of the project, or is it run by a small group of insiders? A decentralized governance model (DAO) allows for community participation and input. Transparency is key. A project’s code, roadmap, and financials should be open and accessible to everyone. This fosters trust and allows the community to verify that the project is operating as advertised.

And let’s not forget the importance of security. Crypto projects are constantly under attack from hackers and scammers. Strong security measures are non-negotiable. This includes regular audits of the smart contracts, implementing multi-factor authentication, and educating users on how to protect their assets. The rise of sophisticated cyberattacks in the digital asset space has been a constant threat, and experts from the Securities and Exchange Commission are constantly warning investors of these risks.

Real-World Examples: Successes and Failures

The crypto world is littered with both shining examples and cautionary tales. Bitcoin, despite its limitations, has demonstrated the power of a fixed supply, simple tokenomics, and a strong community. Ethereum, with its flexible design and smart contract capabilities, has fueled the explosion of DeFi. These are testaments to the power of well-considered project design.

Conversely, many projects have failed due to flawed tokenomics, poor governance, and a lack of real-world utility. These projects often suffer from hyperinflation, centralized control, or a lack of community engagement. The crypto graveyard is full of good ideas that never made it because of bad execution.

The Future of Project Design

The crypto landscape is constantly evolving, and project design is evolving with it. We’re seeing more projects focusing on sustainability, real-world impact, and community engagement. As the market matures, the projects that succeed will be those that prioritize transparency, security, and a genuine commitment to decentralization.

It’s a long game. The volatility and constant changes can rattle even the most hardened veterans. But the underlying ethos—the decentralized nature of crypto and blockchain, and the belief in the technology—is still an idea worth fighting for, like a good cup of coffee. Speaking of which, sometimes you just need something to get your brain firing on all cylinders, you know?

Look, I’ve seen a lot in my time, both the good and the awful. The best thing you can do is learn, ask questions, and never stop being skeptical. And if you need a caffeine boost to stay sharp while navigating the crypto world, well, you know what to do. Grab one of those bold coffee mugs for rebels, and let’s get back to work.